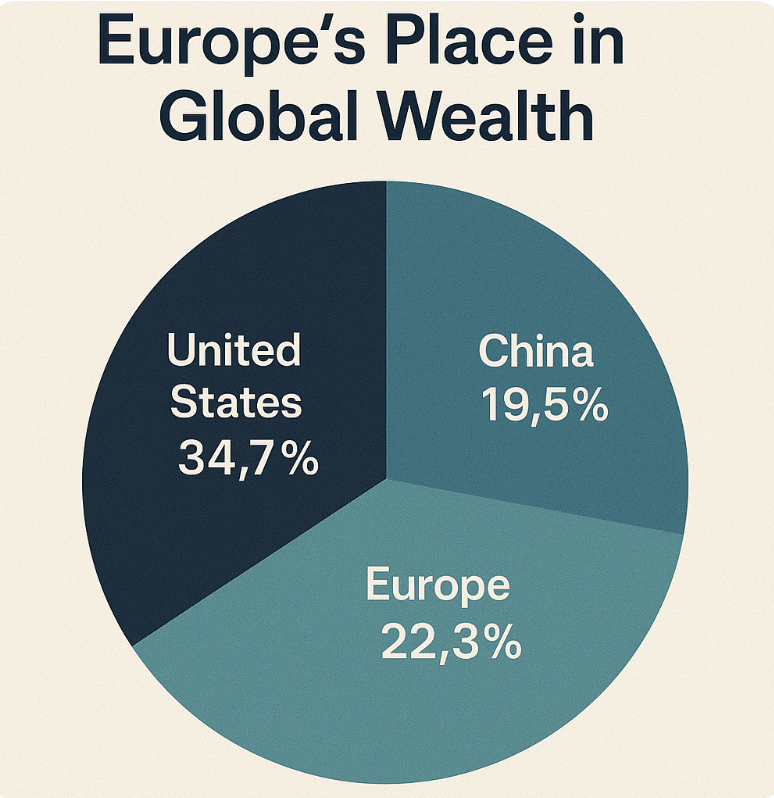

Global wealth in Europe accounts for roughly 22.3% of the total. It is a smaller share than the U.S., but far more complex for corporate treasury management.

Multiple currencies, varied regulations, and diverse liquidity hubs mean your approach to cash management, FX risk, and funding strategy can’t be one-size-fits-all.

This article translates Europe’s market diversity into a practical playbook: where to place cash so it works harder, how to structure hedges across EUR/GBP/CHF and beyond, and which capital-market routes to prioritize as wealth and liquidity shift. If your goals are tighter working-capital cycles, lower all-in funding costs, and more resilient balance sheets, start here and turn Europe’s complexity into your competitive advantage.

UBS Global Wealth Report 2025

- United States: ~34.7%

- China: ~19.5%

- Europe: ~22.3%

- Rest of World: ~23.5%

These percentages are not just numbers; they serve as a map for cash deployment, hedging horizons, and funding strategy.

Why Europe Punches Above Its Weight

Europe’s headline share understates its influence. Europe is much more complex than just one country and its one currency. It involves:

- Multiple liquidity hubs (e.g., Frankfurt, Paris, Amsterdam, Milan, Dublin, Madrid, Zurich, London*).

- Regulatory variety across payments, cash pooling, and bank capital. All affecting pricing and capacity.

- Currency mix (EUR, GBP, CHF, plus Nordics and CEE) a built-in FX laboratory for risk managers.

Bottom line: Europe is not one market. It’s an ecosystem. Get the routing right and you lower costs, improve yield, and de-risk operations.

Practical Treasury Impacts (Action Over Theory)

1) Liquidity & Cash Placement

Park money where markets are deepest – USD, EUR, and strong hubs like London, Frankfurt, Paris, or Hong Kong. That’s where spreads are tight, execution is smooth, and options are plenty.

Then split cash by job:

- Operating = always liquid.

- Strategic = earn some yield.

- Trapped = make it work locally.

Match each bucket to the right account, tenor, and instrument so you’re not risking payroll in a yield hunt or leaving long-term funds idle.

2) FX Exposure & Hedging

If you’re earning and spending in different currencies, the timing gap is the risk. Fix it with a ladder: hedge flows in layers using forwards, add options for protection when volatility spikes.

Don’t hedge just because it’s month-end; hedge around catalysts that actually move markets (central bank meetings, data releases, big auctions). And tailor hedge intensity by currency pair: e.g., lean in on EUR/USD around ECB/Fed weeks, manage RMB via offshore CNH where liquidity is better.

3) Funding Strategy

Bigger, deeper markets (USD, EUR) = more capacity and better pricing. European venues add diversification and competitive tension. Use a mix of tools: deposits for short-term cash, commercial paper for working capital, private placements for flexibility, and bonds for size and visibility.

And remember: cost isn’t just about coupons – structure, covenants, optionality, and swap-backs all shape your true all-in rate.

The U.S. vs. Europe: Scale vs. Sophistication

The U.S. benefits from a single currency and a vast, unified market, which translates into fast execution and consistent documentation. Europe, on the other hand, is a mosaic of venues and regimes, with knobs to twist on pricing, collateral, and format.

But here’s the twist: if you can operationalize that complexity, Europe often delivers superior all-in outcomes across the cycle.

After all, anyone can play in the U.S. sandbox. Europe? That’s for those brave enough to bring a map, a compass… and a good treasury team.

A Playbook for Treasurers Operating in Europe

- Map Your Cash: Daily visibility by entity, currency, and bank. Prioritize in-region pooling where regulation allows.

- Optimize Counterparties: Blend global houses (for balance sheet and distribution) with local champions (for niche pricing and reach).

- Dynamic Hedging Policy: Pre-approve instruments/tenors and automate triggers (budget rates, VAR bands, liquidity stress).

- Funding Optionality: Maintain shelf capacity in at least two regions and two instruments. Don’t be a price taker.

- Regulatory Readiness: Bake KYC/onboarding, intercompany approvals, and cash repatriation constraints into timelines.

- Treasury Tech Stack: TMS + APIs for banks, market data, and payment rails – straight-through (automated) or it doesn’t scale.

Common Pitfalls (And How to Avoid Them)

In treasury, bad habits often come dressed up as best practices. Pooling is a classic: one-size-fits-all looks neat, until local rules remind you otherwise. Better to design structures jurisdiction by jurisdiction than pay for “elegance” later. FX hedging is another trap; tying everything to month-end may look tidy, but markets don’t care about your calendar. Hedge to cash flows and catalysts instead, unless you enjoy awkward CFO conversations. And chasing yield? Sure, extra interest feels good, until you’ve parked payroll money in long-term bets. Keep core liquidity safe, invest only the true excess. Not glamorous, but it’s what keeps the lights on.

How Pecunia Treasury Helps

Build a treasury that actually works for you.

- Cross-border cash structures tailored to your entities and banking footprint.

- FX risk programs aligned to your revenue and cost curves, executed with discipline, not guesswork.

- Funding strategies that mix venues, formats, and investor types to cut your WACC and boost resilience.

Smart capital needs a smarter treasury.

At Pecunia, we put every euro, dollar, and pound to work where it matters most.