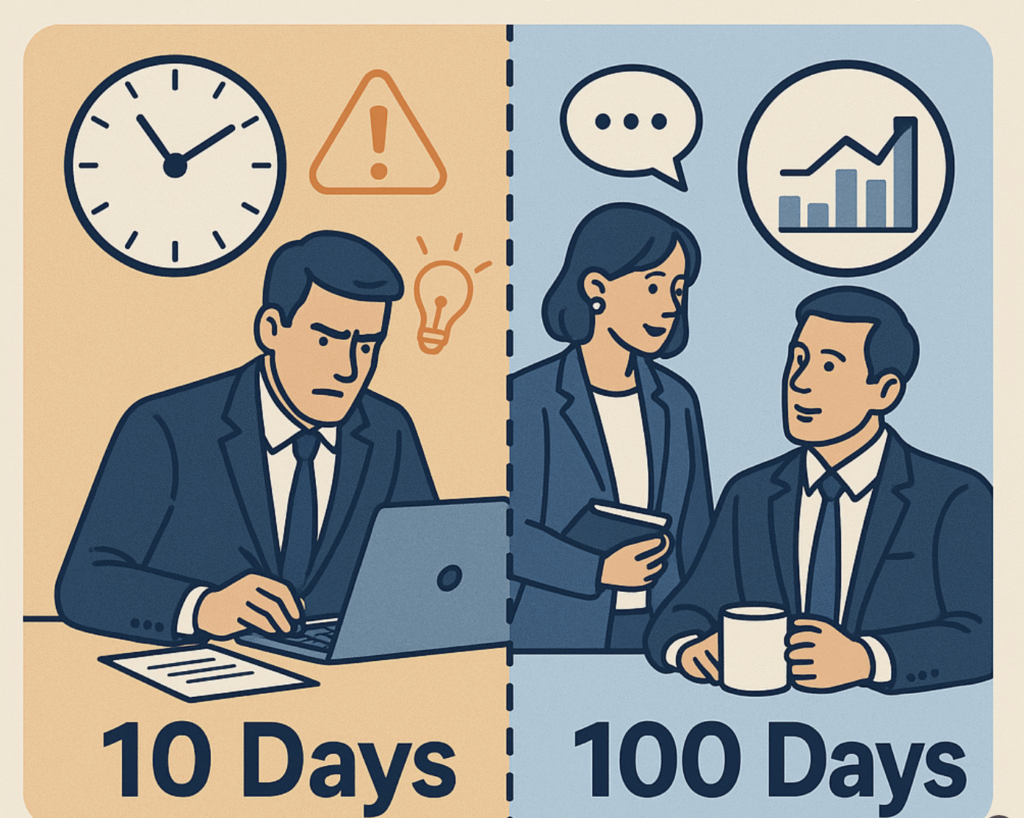

When you start a new permanent role, everyone loves to talk about “the first 100 days.” Ah yes, the honeymoon phase…time to “listen, learn, and build relationships.” You sip coffee, nod wisely in meetings, and promise to “circle back” once you’ve absorbed the culture.

But step into an interim role? Forget 100 days. Try 10, or 5 if the CFO’s already on their second espresso. No one cares if you’ve “built rapport.” They care if you’ve fixed the mess.

Permanent Treasury Role: The 100-Day Discovery Phase

Companies hiring a permanent treasurer expect a slow build:

- Day 1-30: Meet stakeholders, understand the business model, get familiar with systems.

- Day 31-60: Start to diagnose pain points and draft ideas.

- Day 61-100: Present a roadmap, maybe implement the first changes.

The mindset is: “We’ve hired you for the long run. Take your time to get it right.”

Interim Treasurer Role: 10 Days to Prove Value

For an interim? You don’t get that grace period. You’re brought in because:

- There’s a crisis (cash visibility has gone, liquidity is tight, and a fraud incident).

- A project is stuck (cash pool, TMS rollout, bank RFP).

- There’s a capacity gap (sudden resignation, maternity leave, M&A deal closing).

By day 10, you need to:

- Have mapped key stakeholders.

- Know the burning issues.

- Drafted an action plan.

- And ideally, delivered something tangible.

That could be as simple as a liquidity overview, a quick bank fee scan, or a basic automation that saves hours. The point is: your presence needs to be felt.

Example 1: Interim Treasury Quick Win by Day 8

A client brought in an interim because their treasury team was overwhelmed after a sudden resignation. Month-end was approaching, and management had no clear view on short-term liquidity.

By day 8, the interim had:

- Pulled together a daily cash position overview across the main bank accounts.

- Highlighted a mismatch between payables and incoming flows that would cause a short-term dip.

- Suggested a quick fix by shifting idle cash from a sister company, buying the group valuable time.

It wasn’t rocket science, but it created visibility, reduced stress, and reassured management that the basics were under control.

Example 2: Treasury Process Automation During Maternity Leave

Another client needed interim cover for a maternity leave. The professional stepping in had a strong technical background, and that showed immediately.

Within the first two weeks, he had:

- Spotted a few repetitive manual processes draining hours every week.

- Linked Google Sheets directly to live FX rate sources.

- Automated reporting updates, so that reports refreshed themselves instead of relying on copy-paste.

The result? The team saved valuable time each week, which could now be spent on analysis and decision-making. Even better, those small automation wins kept adding value long after the interim had left.

Why the First 10 Days Matter in Interim Treasury Roles

- Credibility is instant currency: If you don’t show value quickly, stakeholders lose confidence fast.

- Momentum matters: Projects don’t wait; markets don’t wait; banks don’t wait. Neither can you.

- Trust builds through action, not words: The quickest way to earn respect as an interim is to solve something visible.

A Simple 10-Day Framework for Interim Treasurers

- Day 1- 3: Listen hard. Stakeholders, processes, systems.

- Day 4-7: Diagnose issues, sketch a pragmatic plan, and validate it with management.

- Day 8-10: Deliver a quick win. Show results, however small.

That early delivery sets the tone for the rest of the assignment.

What Treasury Clients Should Know About Hiring Interims

Hiring an interim is not just about filling a seat until a permanent solution arrives. It’s about impact from day one.

The comparison is simple:

- Permanent: 100 days to settle in.

- Interim: 10 days to show results.

That’s why picking the right interim matters: they need to know how to hit the ground running.

Pecunia’s Edge: Fast Impactful Interim Treasury Solutions

At Pecunia, we see this every day. Our network of interim treasurers has been through dozens of first-10-day situations. They know how to listen, diagnose, and deliver without wasting time.

That’s why clients come to us: not just for a “temporary fix,” but for professionals who bring speed, expertise, and impact.

Because in interim treasury, 10 days can already make the difference between stability and chaos.