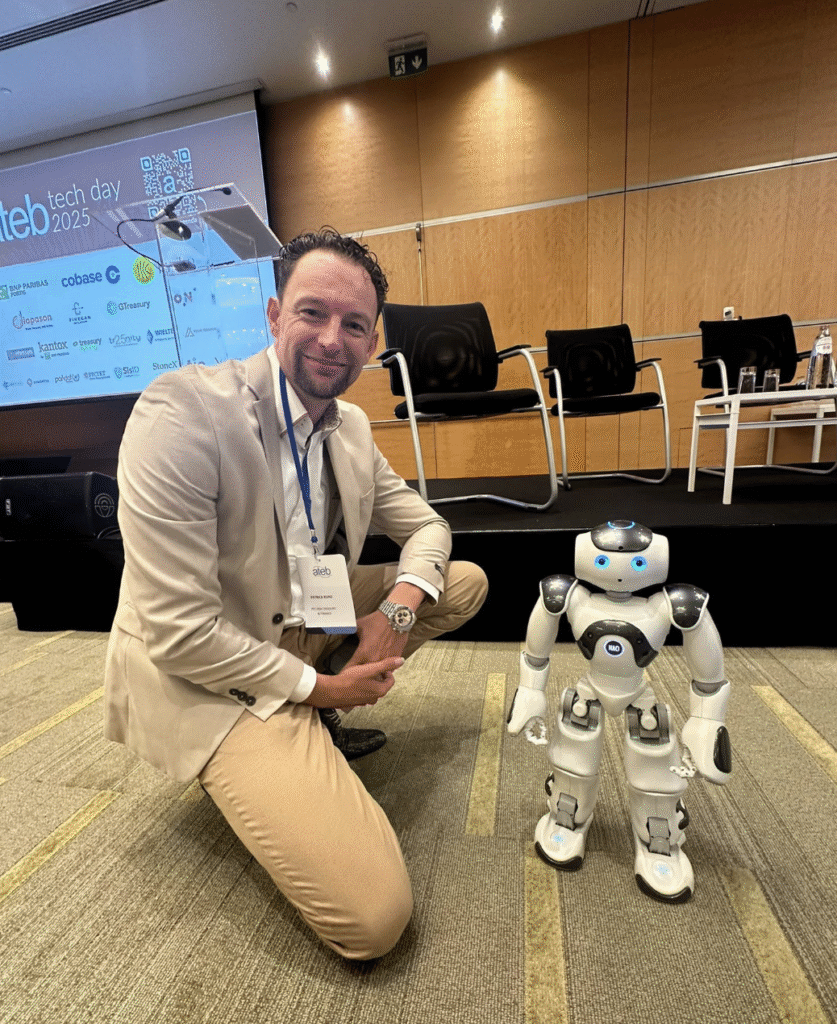

Last week, I had the pleasure of joining Ateb Tech Day, and what a great day it was. You get to meet treasurers, TMS providers, banks, and even an AI robot in one room. Which is exactly why it was so interesting.

Panel 1: The Classic Kickoff

The first panel hit the right note. A treasurer (Anneliese Buttiens from Daikin Europe), a TMS provider (Matthias Varenkamp from Cobase), and a bank (Lipta Mahapatra from BNP Paribas) on stage together, might sound like the start of a bad joke… yet it was just what the treasury needed. Each of them brought their own strategy, strengths, and yes… weaknesses.

- Treasurers bring the reality check: “This needs to work in practice.”

- TMS providers bring innovation: “Here’s what the system can do.”

- Banks bring the regulatory mindset and data: “Here’s what you must do and process.”

It reminded me that in treasury projects, you always need these three voices. Alone, each party has its blind spots. However, when all three meet, the whole picture is back on the map. Bringing them together and leveraging their strengths will be key to improving your tech treasury.

Panel 2: AI, Use Cases & A Robot on Stage

Then came the AI panel. This is where the event got really fun.

Séverine Le Blévennec from Aliaxis was outstanding – clear, engaging, and practical. She made AI relatable for treasurers, showing it’s not just hype, but real use cases we can apply today.

Morne Rossouw from Kyriba added the “in the trenches” perspective. He’s seen pilots, early wins, and also the struggles (data quality, integration, trust). It’s always refreshing to hear vendors discuss both the opportunities and the challenges.

And then… the robot. Yes, they actually brought a robot on stage to answer questions. Some answers were generic (“AI will help you work smarter,” thanks, we know), but that wasn’t the point. The point was: this stuff is already here, not five years away. And seeing it in action, even as a gimmick, makes it feel a lot less sci-fi and a lot more business reality.

My Takeaways

- Partnerships matter: Treasurers, banks, and TMS providers each bring a piece of the puzzle. If you only listen to one side, you’ll miss the gaps.

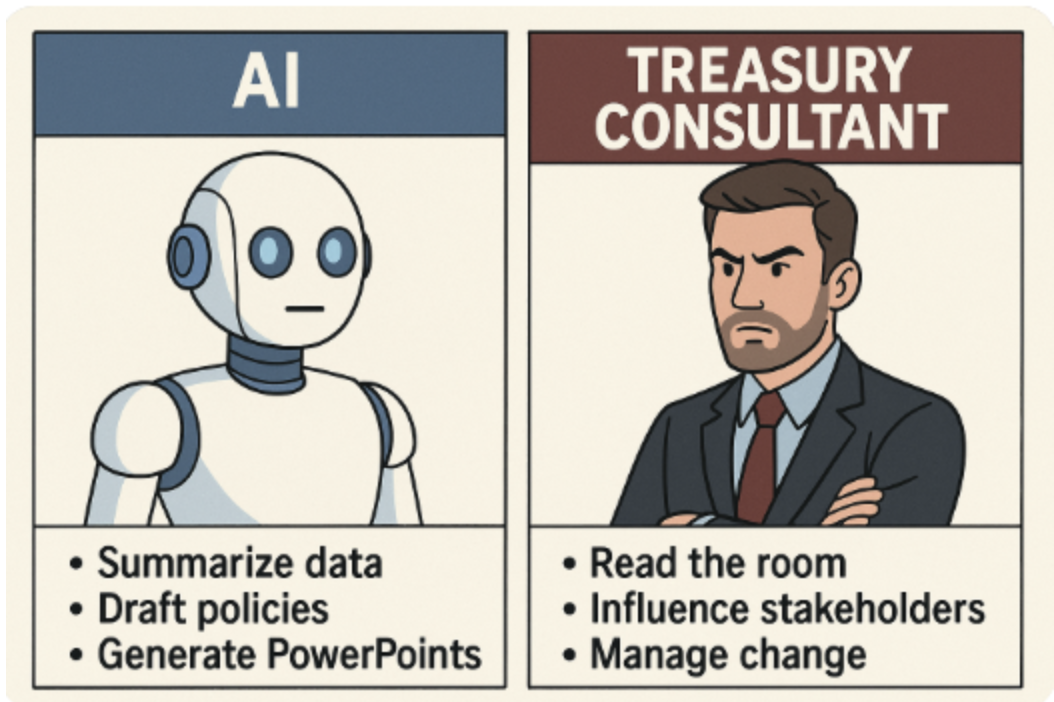

- AI is moving fast: Yes, today’s robot gave generic answers. But tomorrows won’t. Use cases like forecasting, anomaly detection, and risk scoring are already leaving the lab and entering treasury teams.

- Data is still the elephant in the room: AI is only as good as the data you feed it. If your internal data is messy, no AI in the world will fix it.

- Change management is underrated: You don’t just roll out AI, you need to get teams comfortable working with it. Events like this could help integrate AI because they make it tangible.

- Implementation doesn’t have to be hard: With the right partners, some capacity, and a realistic budget, you can break things down into small achievable steps. The end goal will likely continue to evolve; treasury is a continuous improvement journey. (Perfecting the cash flow forecast has been “the goal” forever, and we’re still chasing it!)

Final Thought

Ateb Tech Day showed me two things:

- Treasury is getting more tech-driven by the day.

- And treasurers are ready to engage with it, not just theory, but real tools and use cases.

Add a dash of robotics, and suddenly the future doesn’t feel so far away anymore.

PS: If your team is ready to take the next step but short on hands, Pecunia is ready to help: whether you need an implementation consultant, an automation expert, or even an AI/coding guru to make things happen. Even TMS-certified consultants available. And you will be surprised by the rates!

Contact us HERE https://pecuniatf.nl/contact/